SEASON 3

Episode 1

Date

Mon, 12 October 2026

Time

9am - 5pm

Main Conference

6pm - 10pm

Networking Reception

Location

1 Wimpole Street, Westminster, London, W1G 0AE

"I raised £35K with additional £160K in the pipeline" - Chris Leighton, AirZones

"I raised £15K and I doubled my valuation with SCF capital as a result of the hype around the demo day" - Katrien Grobler, AI KAT

"I pitched at the 1st Money-In and secured my 1st ever cheque of £11K" - Roxanne Pryor, Superoom

"I just closed £300K round with £40K coming from my pitch at the demo day in oct" - Gareth Hawkins, BizChur

"I raised £35K with additional £160K in the pipeline" - Chris Leighton, AirZones "I raised £15K and I doubled my valuation with SCF capital as a result of the hype around the demo day" - Katrien Grobler, AI KAT "I pitched at the 1st Money-In and secured my 1st ever cheque of £11K" - Roxanne Pryor, Superoom "I just closed £300K round with £40K coming from my pitch at the demo day in oct" - Gareth Hawkins, BizChur

London’s Largest Demo Day is back!🚀

Provocative

Bold

Impactful

“I raised £500K as a result of pitching at the Demo Day“ - JP Schepens, AxonJay

“The team pulled off an incredible day featuring some of the most exciting startups in the UK “ - Seb Haire, Google Cloud AxonJay

“Best startup event of the year!” - Katrien Grobler, AI Kat

“The biggest event so far this year in London's startup scene” - Eva Dobrzanska, Sixth Wave Ventures

“I raised £500K as a result of pitching at the Demo Day“ - JP Schepens, AxonJay “The team pulled off an incredible day featuring some of the most exciting startups in the UK “ - Seb Haire, Google Cloud AxonJay “Best startup event of the year!” - Katrien Grobler, AI Kat “The biggest event so far this year in London's startup scene” - Eva Dobrzanska, Sixth Wave Ventures

Partners

Live streaming partner

Quiet room partner

Child care partner

Pitch-practice partner

Training venue partner

Incident reporting partner

Cloakroom partner

DEIA audit partner

investor partners

“Well, that was fun!” - Chris Howard, Investor

“It was a great event with so many talented minds” - Jiri Mcc, GIVE™

“It was AMAZING and just the best event!” - Steven Milne, impro

“The quality of pitching founders was outstanding” - Ivo Ronner, Swiss Post Ventures

“Well, that was fun!” - Chris Howard, Investor “It was a great event with so many talented minds” - Jiri Mcc, GIVE™ “It was AMAZING and just the best event!” - Steven Milne, impro “The quality of pitching founders was outstanding” - Ivo Ronner, Swiss Post Ventures

Community partners

“Congrats on an excellent event! Everything ran smoothly" — from preparation and communication to engaging panel discussions” -Kristin Bjelland, Family Office

“Brilliant event! Highly recommend it to all investors seeking new opportunities.” - David Levine, Manchester Angels

“A fantastic event—my first in the UK in over 5 years!” - Richard Hadler, Founders Capital

“The quality of pitching founders was outstanding” - Ivo Ronner, Swiss Post Ventures

“Congrats on an excellent event! Everything ran smoothly" — from preparation and communication to engaging panel discussions” -Kristin Bjelland, Family Office “Brilliant event! Highly recommend it to all investors seeking new opportunities.” - David Levine, Manchester Angels “A fantastic event—my first in the UK in over 5 years!” - Richard Hadler, Founders Capital “The quality of pitching founders was outstanding” - Ivo Ronner, Swiss Post Ventures

Event structure

Main conference

9am-5pm

2,000+ attendees

450+ investors

800+ startups attending

100 best startups pitching

2 pitching stages

2 content stages

121 networking area

Exhibitor area

Conference mobile app

Wellness & quiet area

Conference mobile app

Childcare room

Drinks reception

6pm-10pm

250+ attendees

Networking

Drinks reception

"It has been a fantastic day!" - Greg Mccallum, No Bull S##t

"It was exceptionally well run, had a brilliant turn out" - Sam Merullo, Family Office

"I really enjoyed the event" - Jonny McNamara, Innovate UK

"It was the best event I've been to this year!" - Michael Rees, Praetura Ventures

"It has been a fantastic day!" - Greg Mccallum, No Bull S##t "It was exceptionally well run, had a brilliant turn out" - Sam Merullo, Family Office "I really enjoyed the event" - Jonny McNamara, Innovate UK "It was the best event I've been to this year!" - Michael Rees, Praetura Ventures

pitching Agenda

Pitching Stage 1

-

Innovations improving food production, delivery, nutrition, or sustainability in the food and beverage sector. Example: Alternative proteins, personalized nutrition, or sustainable packaging.

-

Solutions addressing climate change, renewable energy, energy efficiency, and environmental sustainability. Example: Solar energy, carbon capture, or sustainable agriculture.

-

Innovations in entertainment, media, and leisure experiences. Example: Streaming platforms, immersive media, or gamified experiences.

-

Transforming the retail experience to encourage sustainable and ethical consumer habits. Example: Circular economy platforms or personalized shopping solutions.

-

Solving challenges in education and training to improve learning outcomes and accessibility. Example: Online learning tools, VR training, or adaptive learning systems.

-

Enhancing how individuals and teams innovate, create, and achieve their goals. Example: Productivity apps, creative software, or collaboration tools.

Pitching Stage 2

-

Innovations in customer engagement, retention, and relationship management. Example: Loyalty programs, AI-driven customer support, or CRM systems.

-

Transforming workplaces to increase productivity, inclusivity, and collaboration. Example: Employee engagement tools, hybrid work solutions, or HR tech platforms.

-

Advancements aimed at improving lifespan, healthspan, and overall well-being. Example: Telemedicine, wellness apps, or anti-aging research.

-

Solutions improving financial systems, increasing accessibility, and leveraging innovative technologies. Example: Digital wallets, microfinancing platforms, or blockchain for financial services.

-

Bridging the gap between scientific research and practical, scalable technologies. Example: Quantum computing applications or lab-to-market biotech solutions.

-

Innovations enhancing urban infrastructure, transportation, and smart living. Example: EV charging networks, smart city planning tools, or ride-sharing platforms.

-

Unique or interdisciplinary solutions that don’t fit into traditional categories. Example: Novel applications in niche markets or breakthroughs in unconventional fields.

“Well, that was fun!” - Chris Howard, Investor

“It was a great event with so many talented minds” - Jiri Mcc, GIVE™

“It was AMAZING and just the best event!” - Steven Milne, impro

“The quality of pitching founders was outstanding” - Ivo Ronner, Swiss Post Ventures

“Well, that was fun!” - Chris Howard, Investor “It was a great event with so many talented minds” - Jiri Mcc, GIVE™ “It was AMAZING and just the best event!” - Steven Milne, impro “The quality of pitching founders was outstanding” - Ivo Ronner, Swiss Post Ventures

content Agenda 2025

2026 agenda will be announced in Q2 2026

LIght side of the money STAGE

-

This session explores why sacrificing some ownership is often necessary for scaling fast and accessing resources only investors can provide, debunking the fear of giving up equity.

-

A bold discussion on how strategic use of investment capital can accelerate growth, dominate markets, and leave competitors in the dust.

-

Practical advice for maintaining control and building a mutually beneficial partnership with investors, ensuring your goals align without compromising your vision.

-

A fascinating dive into the behavioral psychology of venture capital, exploring how founders can leverage cognitive biases, herd mentality, and narrative-building to secure higher valuations and investor confidence.

-

An honest discussion on the role of personal branding, charisma, and storytelling in convincing investors to fund your startup, often more critical than the product itself.

-

A candid panel on how the VC ecosystem operates like a powerful network, where being part of it can mean rapid growth and success, but staying out can mean isolation and struggle in a hyper-competitive startup world.

dark side of the money stage

-

- Founders they backed that didn’t work out — not just for business reasons but for misalignment, character, or speed.

- What red flags they ignored because of FOMO.

- The types of founders they’ll never invest in again (and why).

-

A brutally honest one-on-one interview with a founder who saw the red flags, ignored them, and took the money anyway. What followed was a slow unraveling—power struggles, broken trust, and the eventual collapse of a once-promising business. But this isn’t just a story of failure—it’s a story of survival, self-awareness, and what happens when founders choose short-term funding over long-term alignment.

This conversation will cut through the polished PR stories and go deep into what really happens when you get into business with the wrong people—and how to recover when it all goes wrong. -

Candid stories of founders whose mental health, relationships, and personal lives were destroyed by the relentless demands of their investors.

-

An unfiltered discussion on the power dynamics that shift when founders give up majority ownership, exploring the loss of control, decision-making authority, and the risks of becoming a minority stakeholder in your own business.

-

A deep dive into how venture funds operate, revealing that the pressure for rapid growth often stems from their need to raise the next fund rather than your business’s needs. This session exposes how aligning your startup’s pace with their fundraising cycle can lead to reckless decisions that kill businesses.

-

A bold argument against the VC model, showcasing bootstrapped founders who built sustainable businesses without outside capital.

Speakers 2025 (2026 TBC in Q2)

-

Dan Bowyer

Partner at SuperSeed VC

-

Ivo Ronner

VC Investor at Die Schweizerische Post

-

Lyubov Guk

Founding Partner at Blue Lake VC

-

Dermot Campbell

CEO & Founder at SEEIO

-

Joe Watts

Senior Director at Edelman

-

Thea Montgomerie Anderson

Founder / Editor at AI Spy Media

-

Michael Blakley

Co-founder & CEO at Equitas

-

Chris Howard

Founder, Investor, Researcher at MIT

-

Nick Sachs

Co-Founder/COO at Tapio Capital

-

M Coyle

Co-Founder at hotbed

-

Hanna Lewis

Investor at Blue Wire Capital

-

Toyosi Ogedengbe

Principal at Ascension VC

-

Michael Eisenberg

Founder & Managing Partner at Genuine Capital

-

Cien Solon

Co-Founder at LaunchLemonade

-

Ken Thomas

Principal at BackFuture VC

-

Anthony Rose

Founder and CEO at SeedLegals

-

Richard Kivel

Managing Director at GrayBella Capital

-

Dan Rosenberg

Co-Founder and CEO at LinkyThinks

-

Jonny Plein

C-Founder at YASO

-

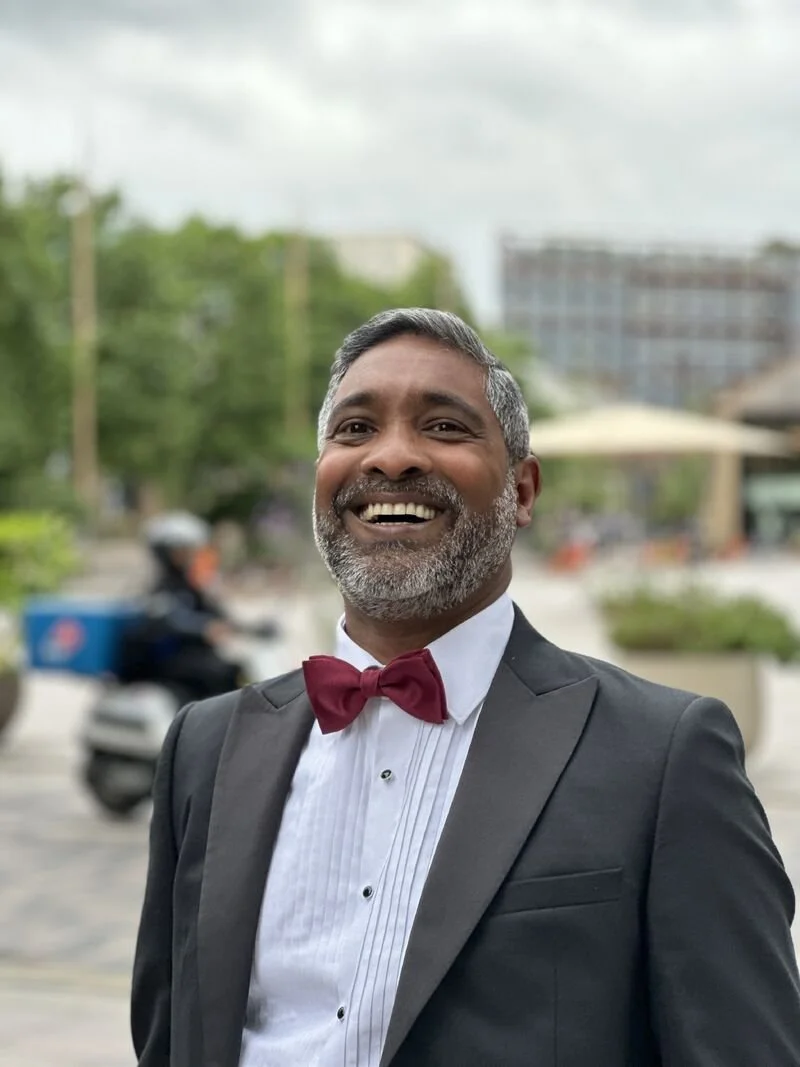

Kevin Withane

CEO at Diversity X

-

Kyle Masterson

Co-founder and Investment Lead at Ignite Incubator

-

David Gilgur

Founding Partner at Blue Lake VC

-

Daniel Torres

Portfolio CFO at Sabio Solutions

-

Amy Thomson

Co-Founder and CEO at Moody Month

-

Nick Telson-Sillett

Co-Founder at trumpet

-

Soma Pirityi

Former VC, Co-Founder at ETA Technologies

-

Anmol Goel

Partner at Gacs Ltd & Gacsym Ventures

-

Nick Coleman

Founder and CEO at Hero

-

Mollie Claypool

Co-Founder & CEO at Automated Architecture

-

Kevin Smith

CEO at Venture Comet

-

Kristina Mydlar

Founder and CEO at Mydlar Consulting

-

Hattie Willis

Co-Founder at IfWeRaise

-

Rosamund Heathcote

Founder at Borough Broth

-

Nate Kelleher

Founder and Director, The Entrepreneurs Group

“Congrats on an excellent event! Everything ran smoothly" — from preparation and communication to engaging panel discussions” -Kristin Bjelland, Family Office

“Brilliant event! Highly recommend it to all investors seeking new opportunities.” - David Levine, Manchester Angels

“A fantastic event—my first in the UK in over 5 years!” - Richard Hadler, Founders Capital

“The quality of pitching founders was outstanding” - Ivo Ronner, Swiss Post Ventures

“Congrats on an excellent event! Everything ran smoothly" — from preparation and communication to engaging panel discussions” -Kristin Bjelland, Family Office “Brilliant event! Highly recommend it to all investors seeking new opportunities.” - David Levine, Manchester Angels “A fantastic event—my first in the UK in over 5 years!” - Richard Hadler, Founders Capital “The quality of pitching founders was outstanding” - Ivo Ronner, Swiss Post Ventures

media partners

If you have 1K+, 10K+, or 100K+ email subscribers (startup, tech, VC, or business audience), you can become our media partner to get mutual PR

FAQs

startups

-

To be considered, your business should meet the following criteria:

Any sector

Raising from Pre-Seed to Series A+ rounds

Clear vision for global expansion

Actively fundraising

-

Join the waitlist to be notified when applications go live.

-

Selection is based on innovation, market potential, team strength, and traction/ validation. All decks are reviewed by our investor partners and the wider audience of the startup community.

-

Due to the volume of applications, individual feedback is not guaranteed.

-

Yes, there is no cost to apply, or pitch at demo day.

-

Once applications close, our investor partners and the wider startup audience vote on the startups they think are most promising. We will then tell you whether or not you’ve been successful and include next steps. The top 100 finalists will be announced 1 month before the event date.

investor partners

-

Please apply using this form.

-

Investor partners help us to promote the event and review submitted decks to help select the most promising startups for the event.

-

Yes, the event includes networking sessions for direct interactions with founders.

-

Only those investors who actively help with promotion and applications rating will get access to the deal flow.

Sponsors

-

We offer various tiers of sponsorship. Please contact us for detailed information.

-

Sponsors receive visibility through event branding, promotional materials, and specific engagement opportunities based on the sponsorship level. Contact us for more information.

-

Yes, the event includes networking sessions for direct interactions with founders. Contact us for more information.

attendees

-

There will be an option for you to get a free ticket. Join the waitlist to be notified about the details.

Contact us.

info@rarefounders.com

London, UK